Does Car Insurance Cover Repairs?

When your car needs repairs, you may wonder if your auto insurance will help pay for the expenses. While car insurance generally covers vehicle repairs caused by events such as a car collision, natural disaster, or vandalism, you can’t count on insurance to pay for repairs that result from lack of maintenance or mechanical problems.

To further explore what your car insurance covers, it is helpful to break down different types of car insurance and what they cover and look at what kinds of repairs are typically not covered under most policies. It is also beneficial to consider how you can minimize the need for car repairs, such as keeping up with routine maintenance and protecting it with a custom car cover when parked, to avoid the hassle of dealing with insurance claims.

Shop Our Entire Selection of Car Covers

Car Insurance: The Basics

Car insurance is an agreement made between you and an insurance company. In exchange for a yearly premium, the company agrees to provide you with a certain amount of financial protection if your vehicle sustains damage in an accident. Your policy type and coverage are optional and will be outlined in your specific insurance policy. While there are hundreds of car insurance providers in the U.S, most of them offer the following basic types of policies and coverage:

• Collision Coverage

Collision coverage is a type of insurance that pays for repairs to your car after an accident. Collision insurance generally covers damage incurred when you run into another vehicle, a stationary object like a fence or tree, or even a road structure like a telephone pole or guardrail. This type of coverage only applies to your car and does not cover damage to another driver’s vehicle. Therefore, it is optional in most states unless you rent or lease your car.

• Liability

Liability auto insurance pays for damages to another driver’s car, as well as any physical injuries they suffer if you are found liable for an accident. This type of car insurance is required in most states, and there are significant variations on the limits that different policies cover. This type of insurance does not cover your own car’s repairs in the event of an accident, only that of the other person or persons involved.

• Comprehensive Coverage

Comprehensive coverage applies to a wide array of circumstances outside of a collision. These include damage caused by fire, falling objects, animal damage, vandalism, and natural disasters. One natural element that people often worry about is hail. Does insurance cover hail damage? Yes, comprehensive coverage covers hail damage to your vehicle, but other types of auto insurance alone won’t. Because comprehensive insurance only protects your vehicle, the coverage limit or maximum amount the insurance company will pay for the repairs, is based on the value of your car.

• Deductible

A deductible is the amount of money you put toward an insurance claim. For instance, if you have a $500 deductible and you need to file a claim for $1,000 for damages to your car, you’ll have to pay your $500 share before you can receive the insurance company’s portion. Deductible amounts vary based on several factors; however, it is generally the case that the higher your deductible amount, the lower your yearly premium will be.

• Full Coverage

Full coverage insurance means different things, depending on your insurance providers, but it typically refers to the combination of liability, comprehensive, and collision insurance. This is the most costly type of insurance to carry. However, it gives you the most protection in the event of any kind of accident or damage to your vehicle caused by events outside of your control.

• Car Repair Insurance

Car repair insurance is an option for some drivers. This covers mechanical breakdowns and issues like cooling systems, electrical systems, engine problems, exhaust, fuel systems, transmission, and steering components. This coverage is beneficial, but it is not available on all vehicles and is not a standard type of auto insurance. Additionally, it does not cover issues caused by improper maintenance, harmful driving conditions, and general wear and tear.

Types of Repairs Covered by Insurance

When your car is damaged, the first thing you should do is to check with your insurance provider about repairs. Their experience and knowledge of your policy can help guide you toward the next steps. If you’ve been in an accident with another vehicle, you may not be dealing with your insurance company. When the accident is deemed the other driver’s fault, they must pay for the repair expenses. The following are common types of repairs caused by collisions or comprehensive circumstances covered by car insurance:

• Dents, scratches, and paint

• Broken windows, windshield, and lights

• Total car replacement

• Damaged tires

• Stolen or damaged car parts due to vandalism

• Damage due to hitting an animal

• Fire damage from a collision or natural disaster

What Isn’t Covered

Most car insurance policies allow you to obtain coverage for scenarios relating to collisions and damages caused by events outside of your control, but does car insurance cover repairs caused by other circumstances? The general answer is no. No type of car insurance covers necessary repairs due to poor maintenance, everyday wear and tear, corrosion, and rust or pre-existing conditions on the car. Additionally, unless you go out of your way to purchase car repair insurance, don’t expect mechanical breakdown issues to be covered, either. The following are types of repairs and general upkeep that are not paid for by insurance:

• Routine maintenance such as suspension alignment, tire rotation, wheel balancing, and engine tune-ups

• Brake replacement due to worn brake pads

• Tire replacement due to bald tires

• Damage caused by improper maintenance

• Damage to vehicle molding or trim

• Corrosion

• Rust

• Part replacement due to age or poor maintenance

How to Protect Your Car

Car insurance is only one layer of protection for your vehicle. However, it doesn’t cover everything that can damage your car. As a responsible car owner, you should take several steps to keep your vehicle in pristine working order.

Routine Maintenance

Every car needs regular maintenance to run at its best. Failure to complete routine maintenance tasks can prevent your insurance company from paying out a claim and void your manufacturer's warranty. This can leave you with a broken-down vehicle and an expensive bill to pay.

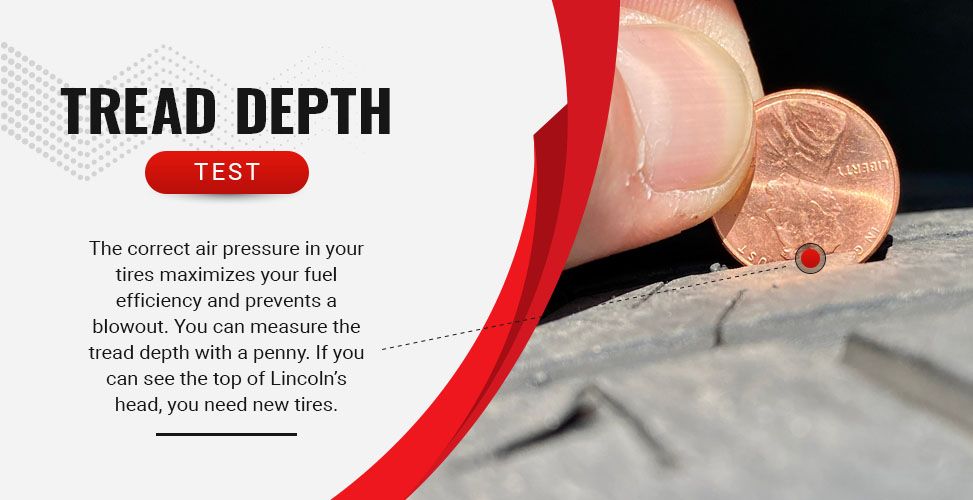

Each month, you should be checking your tires for air pressure and tread depth. The correct air pressure in your tires maximizes your fuel efficiency and prevents a blowout. You can measure the tread depth with a penny. If you can see the top of Lincoln’s head, you need new tires. Bald tires can lead to an accident and reduce the maneuverability of your vehicle.

The number of miles you drive annually determines how often you need to change the oil on your vehicle. At a minimum, you should change the oil every six months to protect your vehicle’s engine. Your car’s air filter should be changed at least once a year. Make it a habit to check the air filter when you get an oil change so you don’t miss out on this maintenance task.

Theft Prevention

Car thieves can cause significant damage to your vehicle. The theft of items from your car is just as problematic and can cause a considerable headache for you. Following simple rules can help you prevent damage to your vehicle from theft. Whenever possible, you should park in a well-lit area. If you need to store items in your car, make sure they are covered or out of sight. Don’t leave charging cables hanging out where they are easily spotted. This can signal to thieves that something valuable might be inside. If you live in an area where car theft is common, you might want to invest in a vehicle immobilizer and tracking system. This can render your car inoperable should thieves gain access.

Protection from the Elements

If you frequently park outdoors for long periods, you need a plan to protect your car from the elements. Sun, dust, and hail can all damage the exterior of your vehicle and require significant repairs. Washing your car is a great way to protect it from damage that can build over time spent outside. A weekly wash and wax routine can prevent dirt buildup that may damage the paint. Always dry your car completely, using a microfiber cloth if necessary to avoid calcifications from dried water droplets.

Get in the habit of covering your car with a fitted car cover to protect it from the elements. Even if your vehicle is just parked for the night outside, using a car cover can prevent damage. If you live in an area where hail is a threat, protection with a hail car cover can save your car from costly dents and broken glass. These powerful covers inflate to absorb the impact of any size of hail and deflect it away from your car’s surface.

Car covers protect your car from developing rust damage that isn’t typically covered by insurance. Damaging rust can form on your vehicle’s frame after a rainstorm or driving in wet conditions. A fitted car cover protects your vehicle from getting wet if it is outside during a storm. It also helps prevent rust by allowing water to evaporate off the car through the breathable fabric.

CarCovers.com has a vast selection of high-quality semi-custom covers available, including our Platinum Shield, which features three layers of protection that can outperform high-end 5L covers. The outer polyester layer is water-resistant and is coated to reflect UV rays and prevent heat damage. The inner layer is made from ultra-soft fleece, so it’s gentle on car paint and minimizes scratches and dents. All our covers come with an elasticized front and rear hem that ensures the best fit possible. You can use our convenient search tool to find the perfect cover match for your vehicle’s make and model.

Browse All of Car Cover Accessories

Don’t Rely on Insurance

If you have comprehensive car insurance, you may feel more protected than if you opt solely for liability or collision insurance. While it is true that damage caused by hail, ice, or snowstorms may be covered by comprehensive insurance, it is more effective to protect your car with a weather-proof custom cover before harm occurs.

The reasons for this are the three main complications that arise when dealing with insurance companies. The process of filing a claim is a huge hassle. You need to gather evidence of the damage and prove that it was not pre-existing on your vehicle. Additionally, insurance companies require you to work with a claims adjuster and file layers of documents to cover the repairs. Even when you follow the claim procedure, you may end up with a less than satisfactory payment from your insurance.

You may believe that you are covered for specific scenarios, only to find out when you go to file that you are not. Insurance policies are complex and often misrepresented by agents. Unless you read all the fine print on your policy, you may be in for an unwelcome surprise. Finally, insurance policies have coverage caps that mark the highest amount of repairs that will be covered. You can’t predict what the damage from a natural disaster will be. Therefore, comprehensive insurance may not even cover all the necessary repairs.

Prevent Repairs with a Custom Car Cover

With a custom car cover from CarCovers.com, you prevent damage to your vehicle and minimize the need for costly repairs. Although every vehicle is subject to wear and tear over time, when you protect your SUV, car, van, or motorcycle with a perfectly fitted cover, you add years to the life of your vehicle. CarCovers.com offers covers for every vehicle, along with accessories like floor mats and cleaning kits so you can care for your car and avoid the hassle of dealing with an insurance company.

Updated