Should I Lease or Buy a Vehicle? 10 Things to Know

In most parts of the U.S., having a car is essential for getting to work, shopping, and running errands. Although some city-dwellers go without a car, having one comes in handy for longer chores, especially since public transportation can be unreliable. Buying or leasing your first vehicle can seem daunting, and even getting a second vehicle or trading in one can be a challenge. Car dealerships care about you as a customer, but they are also hoping to make money and may resort to aggressive tactics to close a sale.

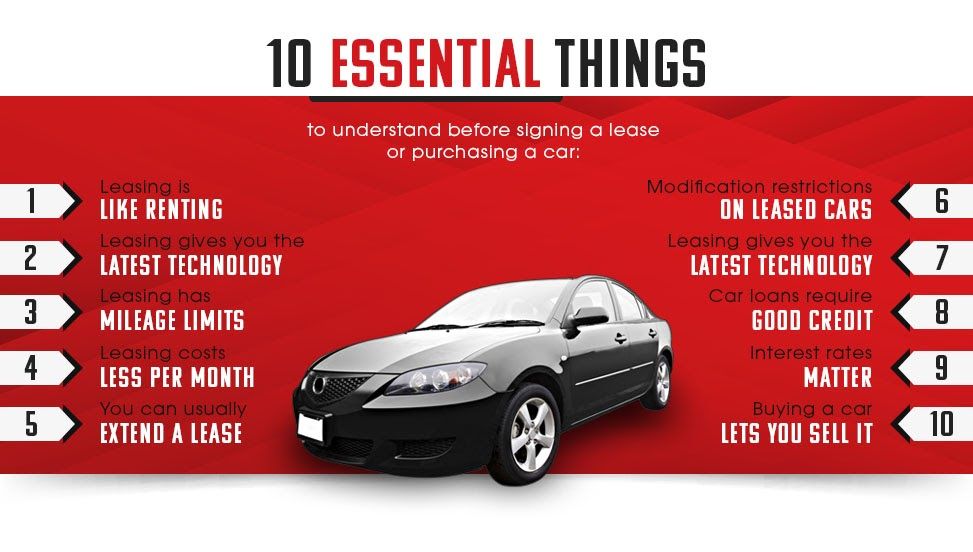

Sometimes, leasing may be a better option than buying. Leasing often results in lower monthly payments than buying a car outright and is a popular option for more expensive cars that most buyers can’t afford to own. However, leasing comes with drawbacks, and many families find that buying a car is a more worthwhile investment. Here are ten essential things to understand before signing a lease or purchasing a car.

- Leasing is like renting.The difference between leasing and buying is like the difference between renting an apartment and buying a home. Leasing a car requires you to pay monthly to borrow the car but gives you no ownership rights. There is a set contract length, which is typically 36 months. Buying a car usually requires you to take out a car loan, just as buying a home requires you to take out a mortgage, and may require a significant down payment. You then pay off the car’s entire remaining cost, plus any interest your financial institution charges. Once you finish paying off your loan, the car becomes a part of your family’s wealth and assets.

- Leasing gives you the latest technology.Leasing is an affordable option for trying out the latest models with features like XM Radio, rear park assistance, blind spot monitoring, heads-up displays, and gesture control. Although some of these features are only useful for entertainment or convenience, others can make a significant difference in your safety. If you’re not worried about having the best technology and cutting-edge safety features, then buying may work better for your needs. Buying means you can keep a car for as long as you want, eliminating the learning curve associated with changing cars every few years.

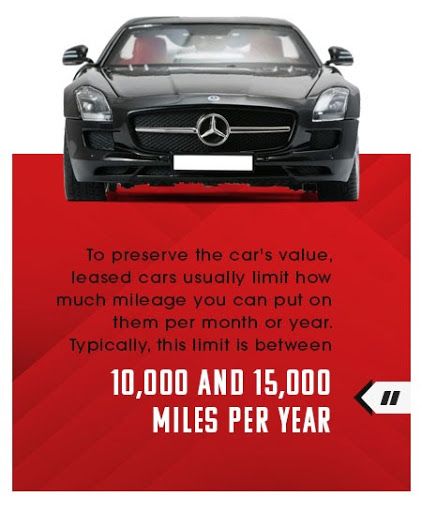

- Leasing has mileage limits.To preserve the car's overall value, leased cars usually limit how much mileage you can put on them per month or year. Typically, this limit is between 10,000 and 15,000 miles per year, but some brands allow you to negotiate a higher limit. Many people who live in the suburbs or the countryside end up exceeding this amount, especially if they use their car to visit family or friends who live in other states. If you’re a single-car household, consider your mileage needs carefully before signing a lease. If you are getting a second car, you have the option of using your leased car for short trips only. If you exceed the mileage by the time your contract ends, you’ll be on the hook for a per-mile fee that’s usually between 15 and 30 cents per mile. This could add up to hundreds of dollars and would be a surprise expense if you don’t keep track of your mileage.

- Leasing costs less per month.Besides having a lower down payment, leasing usually costs less per month. Of course, part of the reason it costs less is the mileage restriction, so there’s a definite trade-off. However, if you want to drive a nice car on a budget, leasing is a great option.

- You can usually extend a lease.Most dealerships will work with you to extend your lease, which gives you additional flexibility. This is helpful if you like the car and want to keep it longer, but it also helps if you need a few extra weeks while you work on securing a different lease. You usually won’t need to come in and sign any additional paperwork, especially if it’s only for a short-term lease.

However, the company usually won’t reduce your monthly payment, even though your car is now older and worth less than when it was initially leased to you. Dealerships know that the more you drive the car, the less they’ll be able to sell it for once it’s back on their lot, so they’ll keep trying to make as much money as possible off the car before its value declines too much. You can even buy the car you’ve been leasing, which may be wise if there’s significant cosmetic damage that the dealer will charge you for anyway. The exact process varies, but most dealerships are happy to have you buy the car from them.

- There are modification and damage restrictions on leased cars.Some wear and tear on leased cars is inevitable, but your lease contract will usually spell out which damage costs you’ll be accountable for at the end of the contract. Typically, any damage to the exterior, cabin, or mechanical parts result in additional fees. Any excessive dirt or stains may result in a cleaning fee, as spelled out in your contract.

If you get into an accident with a leased car, your insurance will cover the cost of repairs, minus your deductible. However, any shoddy repair work may result in additional charges for you when you turn the car back over to the dealership. If you park your car in the street or driveway, you need to protect it from scrapes, scratches, tree sap, bird droppings, UV rays, and other damage from the elements. Purchase our Platinum Shield outdoor car cover for your leased car, truck, or SUV to prevent additional fees from being tacked on when you turn in your car to the dealer.

Your lease contract likely includes some language about reasonable wear and tear and may give size specifications for the types of damage forgivable by the dealership. A typical example is the credit card test, where the dealer uses a template the size of a credit card to determine which damage is too large and to be charged to the customer. Read your contract carefully for language like this and ask about it if the dealer left it out. You cannot modify the seats, stereo, paint color, and other cosmetic or structural aspects of the car without the dealership’s approval. Although most car owners won’t want or need to modify the car within the first few years of driving it, this is something to consider if you’re planning to customize a car.

- Car loans and leases require good credit.Both buying and leasing a car have similar requirements for good credit since both are essentially promises that you’ll pay for the costs associated with the car over time. Dealerships and financial institutions that secure loans look at your income, debts, credit score and history, and other factors to determine if you’re creditworthy. Individuals or couples with poor or no credit may struggle to get approved for either a lease or a loan for buying a car.

However, you may take over someone else’s lease even if you don’t have great credit. Although you’ll still need to have a decent score, new leases have higher credit requirements than lease takeovers. The main problem with lease takeovers is that you become responsible for whatever their monthly payment was, even though the car is in a slightly more worn-out condition than when it was brand new.

If you still struggle to qualify for a lease or loan, consider saving up for a larger down payment. Since credit unions are nonprofit financial institutions, they may be more willing to give you the benefit of the doubt if you have mediocre credit, so check with them as well. - Interest rates matter.

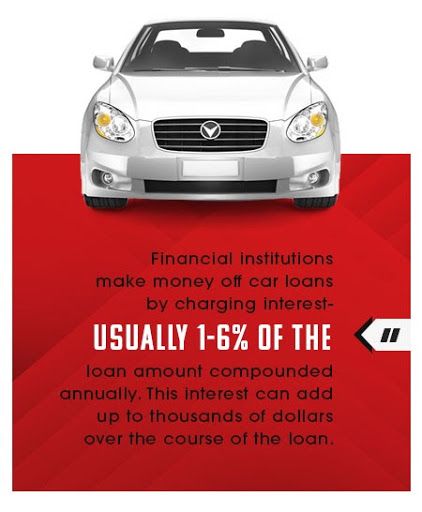

Financial institutions make money off car loans by charging interest—usually 1-6% of the loan amount compounded annually. This interest and any additional fees can add up to thousands of dollars over the course of the loan, especially if you run into any trouble with repayments. If your dealership is offering 0% financing for at least the first part of your car loan arranged through them, then buying a car may be the better option. However, dealer and bank offers vary widely depending on how the market is performing. They may not offer such competitive deals when the economy is doing well, and they’re not as desperate to attract customers. When that happens, leasing may make more financial sense.

- Buying a car lets you sell it.Perhaps the single biggest advantage to buying instead of leasing is that you can sell the car at any point. You can almost always find a dealership that’s willing to buy your car, but they will typically offer you less than what a private buyer will give you. Either way, you can get back some portion of the overall money you spent on the car, especially if it’s in excellent condition with less than 100,000 miles.

If you want to sell the car before you pay off the car loan, you must work out an arrangement where at least part of the car’s purchase price goes toward paying off the loan. In rare cases, your car’s loan amount may be higher than the car’s value, causing what’s known as an underwater loan. However, these cases usually resolve themselves if you make a few more loan payments before attempting to sell the car again.

For purchased cars, protecting your car’s paint job maximizes your resale value and limits damage like rust. An indoor cover becomes especially important since even minor scratches can reduce the car’s value. Preventing dust and damage is essential if you need to store the car long-term. Since you’ll be keeping the car for a long time, invest in a custom-fitted car cover that keeps the elements out. Selling a car can be a hassle compared to returning a leased vehicle, but it’s well worth it if you’re trying to maintain healthy finances. Any cash you get from the sale can go directly toward your down payment for your next car, reducing the amount you have to borrow.

- Protecting your investment is key.Both leased and purchased vehicles deserve the best care possible to maintain their value and avoid unnecessary maintenance costs. They both have similar maintenance needs, but some leases simplify the overall maintenance costs. Brand new cars available for lease sometimes have a clause in the contract stipulating who must pay for the car’s maintenance. A manufacturer’s warranty generally covers leased cars for the contract’s duration, which means the lessee won’t have to cover major issues that are the manufacturer’s fault.

Sometimes the dealer will cover basic tune-ups and maintenance to incentivize the lessee to ensure the car is maintained correctly. However, contracts that include this coverage usually charge more per month. No matter what your lease agreement or car loan looks like, take good care of your vehicle year-round. Prevent scratches by waxing the car and following the dealer’s recommendations for sealant touch-ups. Even if you park your car in a garage, use our Indoor Black Satin Shield car cover to protect it from scrapes, bumps, and items that may fall over. Brush up on basic car maintenance tips to avoid problems that won’t be covered under the manufacturer’s warranty.

Shop Our Entire Selection Of Car Covers

Is It Better to Lease or Buy a Car?

There are many potential upsides to leasing, including the shorter overall commitment. It works especially well for young adults and city-dwellers who don’t drive often. At the end of a lease, you can either turn the car back in and go without one for a while or upgrade to a larger or better car, depending on your needs.

However, most families find that buying a car is a better overall investment. Buying a car gives you something that you can hold on to for as long as possible after it’s paid off and often maintains enough value to be traded in for a new vehicle. Your purchased car may even work well as your child’s first car when he or she is old enough to drive.

Buying a car allows you to worry less about the minor dings, scratches, and spills that often happen while driving. You can also customize and update the inside of the car without running afoul of the dealer’s requirements. Whatever you decide, do your best to maintain your car’s value. Regular cleanings at home and inspections by professionals go a long way toward avoiding problems.

Updated